Just forget the noise and focus on technical analysis and your skills !

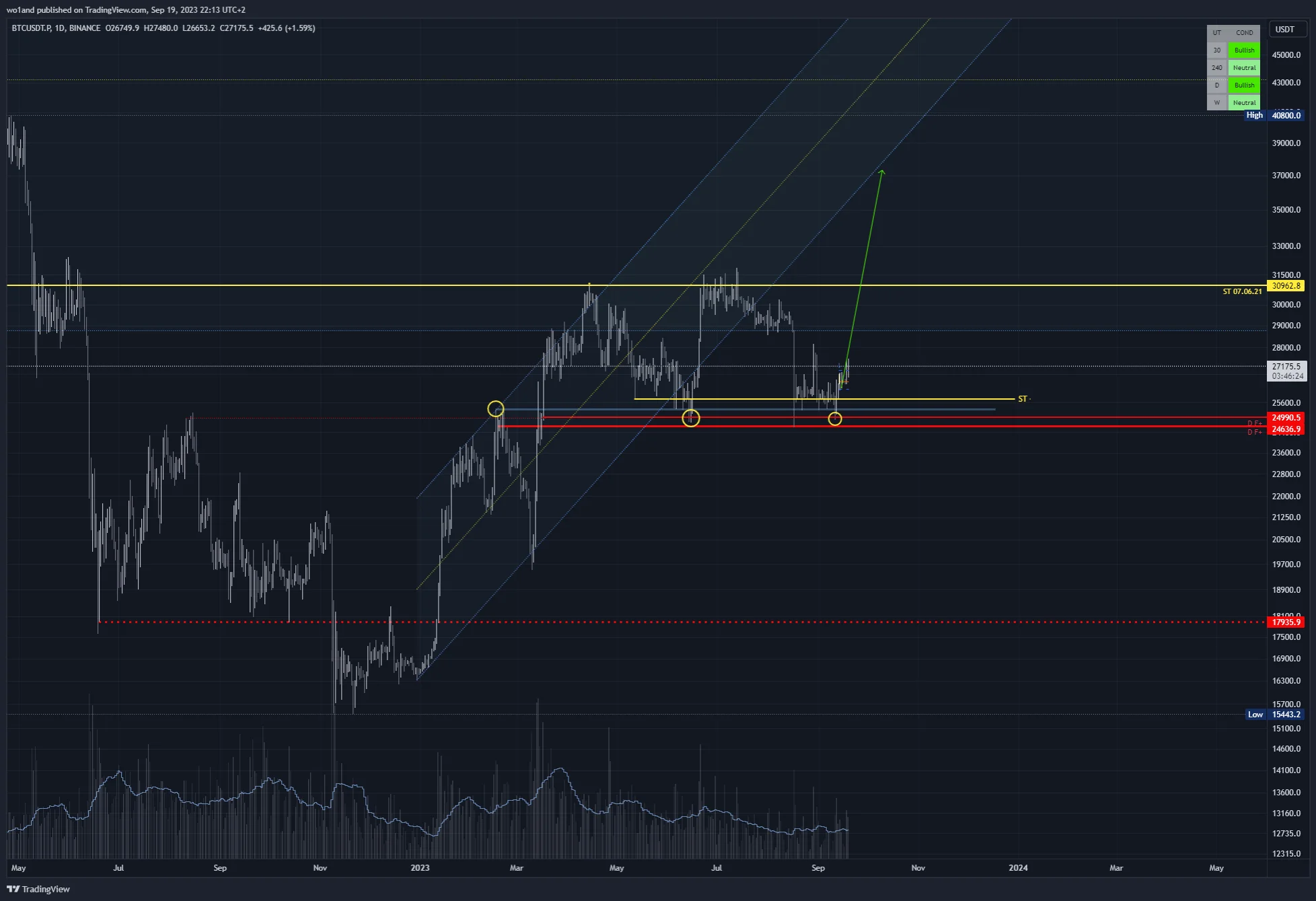

1. CHANNEL ONE

We just left it. 50 EMA will cross the 200 for sure. The “ribbon” is expands. The wider it is, the harder it will be to reverse

And you know how it works : testing the 20 ; maybe rejected ; trying to pass the 34 and kissing the 50… And if rejected again, back to the square one with new lows….

The EMA 200 ?

We didn’t even visit it back since the week as of 13.06.22.

Your Fear scenario !

I told you at the beginning : FORGET THE NOISE ! You should trade without any feelings of anything or being just emotional to believe on a kind of Bull Market as you believe in GOD.

The only positive thing is that we did not Back Up (ICE). In this case The ribbon might struggle then reverse.

What might be this probability ?

Well.. Even if you are going to run to the church to melt all the candles that you could find, be rational when you see this chart…

By the way, we are calling DEATH CROSS when it is Daily… What might the exact term when it happen on W TF ?

2. Paradigm Shift

Change of the channel might signify change of the force and speed of the move. In other words, there is a kind of slowdown. Maybe a trend reversal. This might be an accurate fork that show us we should play in THIS Range and take a break before the EXIT with a clear direction (BULL or BEAR), and the hope staying above the 0.618 (purple).

Ruben VILLAHERMOSA CHAVES opens the grail for us, with a kind of failed structure, and to identify the precise degree of the deviation, CHoCH close its Phase A with the ST, witch is actually “sitting” on the POC.

QUESTION 1 : The move as of 02.03.20, that left 2 Wicks, might be considerated as a ST or volume gambling for a potential SPRING ?

QUESTION 2 : We JAC ! OK ! SO Where is the BackUp ???

ANSWER : Don’t look for it there is none ! 60k+ Figures has just setup the UpThrust zone/level !

As you can see, we reintegrated the Fork of this “failed structure”. The experience of the 0.618 act that, if we break it, collapse will be the gift…

I told you to forget about the noise, but any BAD news, such as nuclear Nuke, or Taiwan Gate, or something else could create enough panic on Markets. this might be a KEY!

I LEAVE YOU THE HOPE, that Market Makers gonna fill the LVN (1). And just this one, with a potential reversal (Q1 2023).

PRAY !

3. THE REALITY

CHoCH /A > Climax @ 19660$ ; AR @ 3120$ ; ST @ 13875$

Phase B > a clear Squeeze (POC kissing) left enough Liquidity… ( LVN 2).

Market Maker has rushed the price out of the Fork (58k+ level).

Is the reACCUMULATION Done ? Are we working on a Potential Back Up ?

Look at the chart! This is a Weekly TF.

Why all your TA on LTF, as I can read on Twitter or any other Social Networks always are accurate, especially when you focus on potential leaved Pool Liquidity… ?

Why this Asset should be an exception, especially when there are levels that we really might visit (5339$ ; 1907$ ; 1288$ ; …490$).

And Finally, regarding your POV , where is the truth between the Mark Up, the Paradigm Shift and the reality ?

MY conclusion.

THE answer should be definitely in the CHANNEL ONE ! Failed circle might be the confirmation of the change of the TREND, and Ruben VILLA HERMOSA CHAVES, again, describes that kind of pattern. Maybe price has left the channel and of course there is a potential BU, at least the “ICE”. Question : WHEN ? But there is a the reverse side of the medal such LVN 2 and more over, such as, forgotten levels below REAL FORK (3).This is what we figure out actually with Altcoins (NEAR, SOL, MATIC…) So why Bitcoin should not suffer the same outcome ?

Definitions :

EMA > Exponential Moving Average

RIBBON > EMAs 20, 34, 50

ICE > Lowest level of the Fork. The opposite is the CREEK

TF > Time Frame (LTF > Low Time Frame)

CHoCH > Change of Character > When the price changes its direction from making LH and LL to HH and HL is called (or opposite)

ST > Secondary Test

POC > Point of Control > It shows where the heaviest institutional volumes got traded

BU > Back Up

AR > Automatic Rally or Auto Reaction

TA > Technical Analysis

LVN > Low volume Node

JAC > Jump Across the Creek