Since Donald Trump’s re-election in 2024, the global geopolitical landscape has entered a period of uncertainty and anticipation. With 70 days until his official inauguration, the Biden administration retains power until January 20, 2025. This timeframe leaves open the possibility for significant foreign policy actions, raising many questions and speculations. Here’s an analysis of the current situation and potential scenarios ahead: this leaves plenty of time for the current administration to exercise the power it has held for the past four years, which could cause some panic in Ukraine. There are ongoing discussions in the UK, with Starmer suggesting allowing Ukraine to use long-range missiles to strike deep inside Russia. This strategy could provoke a response from Russia, potentially positioning the West and Western media to portray Putin as the aggressor. This option is not off the table.

Oil Prices and Trump’s Energy Policy

With Trump in office, we might expect a focus on domestic energy production. If sanctions on Russian oil were revisited, prices could potentially decrease further. However, this would depend on diplomatic relations with Russia, which would take time to establish. If Trump sought closer ties with oil-producing nations like Russia to reduce sanctions, this could stabilize oil markets but also raise ethical and diplomatic concerns. One could consider how these alliances might create tension with other allies or affect the U.S.’s standing on the global stage.

Trump has historically taken a less confrontational stance with Russia than the Biden administration. A move toward de-escalation could be initiated, but it would require cooperation from other key players, including Ukraine and European allies. If Trump pursued a more neutral approach, this might reduce immediate tensions. However, maintaining lasting peace would require a careful strategy, which may at times differ from Trump’s direct style.

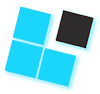

One reason the Biden administration has been heavily invested in Ukraine is the recent discovery of natural resources throughout the region, including crude oil and natural gas in the eastern part of Ukraine. It will be interesting to see if Trump calls for a ceasefire agreement, as this could potentially involve Ukraine giving up land as part of the deal

Germany is currently facing significant challenges due to its reliance on Russian energy imports and the subsequent sanctions imposed following geopolitical tensions. The closure of the Nord Stream pipeline has exacerbated energy shortages, leading to internal political tensions.

In response, Germany and other EU nations are accelerating their transition toward renewable energy sources. However, this shift requires time and substantial investment, potentially leading to short-term economic hardships.

The recent re-election of Donald Trump has introduced additional uncertainties. The German government, already experiencing internal disagreements, is now grappling with the prospect of reduced U.S. support for Ukraine. Under the Biden administration, substantial funding was allocated to support Ukraine amid ongoing conflicts. With Trump’s administration potentially adopting a different stance, Germany and its EU partners may need to reassess their strategies to sustain support for Ukraine independently.

These developments have intensified political instability within Germany, as leaders debate the nation’s role in international conflicts and its energy policies. The combination of energy shortages, economic pressures, and shifting international alliances presents a complex landscape for Germany’s political and economic future.

Implications

Changes in U.S. leadership may shift relations with Russia and Ukraine, but these issues are complex and deeply rooted. If Trump seeks to reduce U.S. involvement in this conflict, he could present this as a national priority.

However, a shift in current commitments may meet international resistance, particularly from NATO allies. We already got Trump frequently criticizing NATO allies for not meeting their commitment to spend 2% of their GDP on defense, calling them “delinquent” and suggesting they were not paying their fair shares which of course goes to our point to that Trump has 70days until they get in office, these sneaky deep state folks will try everything they can to keep the ongoing war with Ukraine.. Like what we have seen with Germany GOV falling, as a nation which is in such decline seeking to use pension funds to fund a war? These elites in the US and EU will have some tricks up the sleeve to poke Putin (THE BEAR) to make him look like the aggressor attacking back…

Of course we have to keep going back to the part that Trump isn’t in the WH until 20th January, as this leaves plenty of time of the old/current administration with the power to still cause some panic in Ukraine and of course with the plan to poke the Russian bear with an attack with him having no choice to attack back which allows the west and western media to point fingers at Putin to call him the aggressor… This is not of the table,

Firstly, I want to mention that we are roughly trading within the same range as discussed in our previous blog, meaning I am still waiting for a break below $65, as it’s a significant level (as you’ll see from our monthly chart). It’s also positive that since then, we have created much more data! We are clearly trending down, with lower highs and lows being formed. I have shaded our range in grey, which has already shown an upthrust above our range high and a tap on our 200 EMA, with us now back within the range and potentially continuing to fall below $65 if the momentum holds.

It could stall…we never know, but from here, shorts look very promising if we continue creating failed structures with lower highs being formed.

Like I said, our $65 crude level comes into play as our FORCE high, and anything below this level is likely to trigger an aggressive move down. That’s why I’m waiting for a break below $65 for a short entry into the FORCE shaded zone. We all know crude is going higher; every single person uses it daily. The entry is a matter of WHEN, not IF.

We also broke out of our downtrend that led up to the GFC crisis and whatever crisis may come next. This is going sky-high, but any entry should be considered below $65, along with any signals from the financial system. Around $50 seems like a reasonable level to start looking for longs once it’s reached, but as ALWAYS, confirmation is key.

Source :

AP News : Germany went from envy of the world to the worst-performing major developed economy. What happened?

CEW : Energy crunch – How does it affect Germany’s climate policy & what can be done?

The Atlantic : Helping Ukraine Is Europe’s Job Now