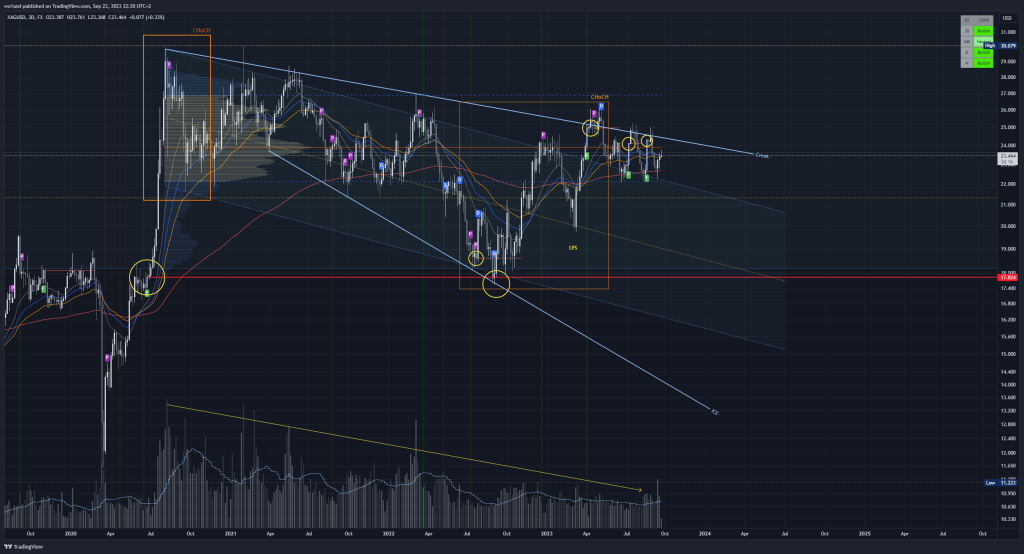

Obviously the re-accumulation is done. $XAG1 has found its Climax2 around 14$, played in Phase B3 for 6 years with an attempt to 21$ thus creating an UpThrust4, till “COVID”, where price collapsed to 11$, found “some” buyers that sent price to the opposite direction.

As you can see JAC5 is obvious ; BU6 seems to be done as well, with #BS Study confirming THE divergence. This “b shape7” is clearly identified, with a SOS8 scenario definitely confirmed, 30$ seems to be just an appetizer.

But if we zoom out on a bigger TF9, it looks like MM10 rushed out PA11 for 6 years before it re-integrated the Fork, kissed the Mid Range (what we called JAC), sitting on the “Preliminary supply” (what we call the UpThrust). What next ?

The larger the timeframe, the more the indicator provides with insight into the acceptance or rejection of strength. “Stochastics” don’t lie and generally the second candle remains an excellent thermometer.

Moreover, if it engulfs the ‘signal’ candle, it is even easier to define a setup for a SHORT with 5.19 RR12, such as SELL $XAG at 28$, STOP13 at 30$; T1 at 21.33$ (PSY level); T2 at 18.19$ (EMA 200).

The second Signal is more tricky. January 23 is a kind of doji ; PA has return in the neutral zone (March, April) ; and now $XAG is supported by the ribbon. In fact, all conditions are met to validate this signal as a potential BUY !

If we add the Screener with all bullish conditions (except H4 > neutral+), the reduction of the volume could confirm a potential spike to the top of the Fork (49.78$).

Little flashback.

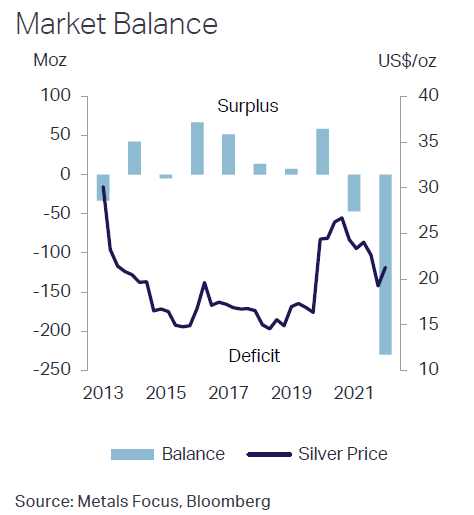

2022 was a year of sharp contrasts between silver’s fundamentals and institutional investor attitudes towards the metal; while the silver market saw what may well have been the largest deficit on record,

professional investors were indifferent or bearish for much of the year. This year was not lost for Bears.

The downward pressure on silver prices from this further boosted physical demand. This was perhaps most pronounced in India, where on top of already exceptionally strong demand, low prices encouraged the entire supply chain to replenish its stocks. This followed two pandemic-hit years of inventory draw-downs. There were other, price agnostic, drivers of demand growth last

year. Most notable among these was the strength of industrial fabrication, in large part linked to the robust solar industry, but also reflecting a postpandemic

recovery in a number of other markets.

Indeed, were it not for China’s zero-COVID policies, global silver demand would have likely been

even greater than the all-time high of 1,242.4Moz (38,643t) it realized in 2022.

A lack of supply gains was another factor contributing to last year’s deficit. Limited organic growth, project delays and disruptions resulted in a marginal decline in mine production while recycling barely rose.

All this culminated in a 237.7Moz (7,393t) deficit, most likely also an all-time record. (There is some uncertainty, as differences in definitions, coverage and methodology between Metals Focus and past data providers to the Silver Institute complicate comparing balances over the past few decades.)

Importantly, the combined 2021 and 2022 deficits more than offset the cumulative surpluses of the previous 11 years.

India

WSS14 published last year a Changing Landscape of Indian Investment. India was currently the world’s third largest silver physical investment market after the US and Germany. The bar market in particular has been extremely successful, with around 500Moz (16,000t) bought cumulatively over the last 10 years. This partly reflects a lack of other silver investment vehicles, such as ETPs15 and digital products, both of which are available in the Indian gold market. For instance, digital gold was introduced in 2016, while mutual funds first launched gold ETPs in 2007. That said, the silver investment market is slowly changing, with digital silver and silver ETPs both launched last year. Looking at these themes in more detail, the growing popularity of e-commerce apps has meant that the likes of Amazon and Flipkart have been selling silver bars online, which can be physically delivered. However, holding physical silver comes with space constraints and security issues. To address these points, digital silver was launched by DIGIGOLD and Kredx; more will no doubt follow should their popularity grow. These allow silver to be bought online, and then have it stored in a vault. Once purchased, the silver can be sold directly for cash, or redeemed in physical form. In addition, the ability to invest as little as one rupee, the ease of transacting, transparency, and the ability to buy/sell at any time make it an attractive product. That apart, in 2021 the Securities and Exchange Board of India, the securities and commodities market regulator, allowed the launch of silver ETPs. Although several mutual funds issued silver ETPs, three are active, Aditya Birla Sun Life, Nippon India and ICICI Prudential, with a combined AUM of Rs 6.3bn ($82m) as of February 2022. Silver ETP fund-of-funds (a fund that invests in its own ETP) were also launched by Nippon India and Aditya Birla Sun Life. Other asset management companies have also filed scheme information documents (SIDs) to launch ETPs. Even though these products are relatively new, as retail investors become more comfortable with them and as financial literacy improves, we expect such products to become more popular. Although there will be some market share loss for bar demand (religious motives drive coin purchases), ultimately, we expect total Indian silver investment to grow.

Russia-Ukraine

Among the key drivers of the silver price in 2022 was the jump in geopolitical concerns following the start of the Russia-Ukraine SMO16. This in turn exacerbated inflationary pressures as commodity prices soared, particularly in the energy complex. Likewise Cryptoassets, precious metals investment continued to benefit from nominal rates still being low and real rates negative at the beginning of the year. This, combined with worries about stagflation or even a recession, kept price expectations positive and in turn encouraged retail investors to buy hard assets including physical silver. The steep decline in LBMA17 silver stocks, along with the phenomenal jump in Indian silver imports, also gained much attention last year, contributing to the positive retail sentiment.

The outbreak of the Russia-Ukraine issue in early 2022 initially benefited both gold and silver; the gold/silver ratio was stable in a 75-80 range for much of Q1. Precious metals came under pressure, however, from late April as aggressive rate hikes by the Fed pushed the US dollar and Treasury yields

higher. This raised the cost of holding precious metals for institutional investors and, with silver’s higher beta, the ratio widened to over 85.

Expectations of sharply higher interest rates in the US were also joined by growing recessionary concerns and this fueled more underperformance by silver, as the metal suffered both as a precious and an industrial commodity. These pressures saw the gold/silver ratio touching 95 by September.

A pullback to back below 80 then emerged towards the end of the year amid expectations that the Fed would slow its pace of rate hikes. Silver underperformed early on in 2023 despite tailwinds from China’s re-opening and the benefit provided to industrial metals as expectations that the Fed would adopt a more dovish stance encouraged investors to buy into gold.

Amid all this, institutional and retail investment sentiment diverged at times during 2022. Geopolitical uncertainties, concerns about growth and inflation, all supported retail interest throughout the year. This was especially true when professional activity weighed on silver, as retail investors, particularly

in North America and Europe, took advantage of ensuing low prices to purchase silver coins and bars, pushing combined sales in these two regions to the highest total in Metals Focus’ series. Indian physical investment saw a stunning recovery after two-years of below par demand, as lower prices and

investment holdings starting the year at a low level led to renewed buying.

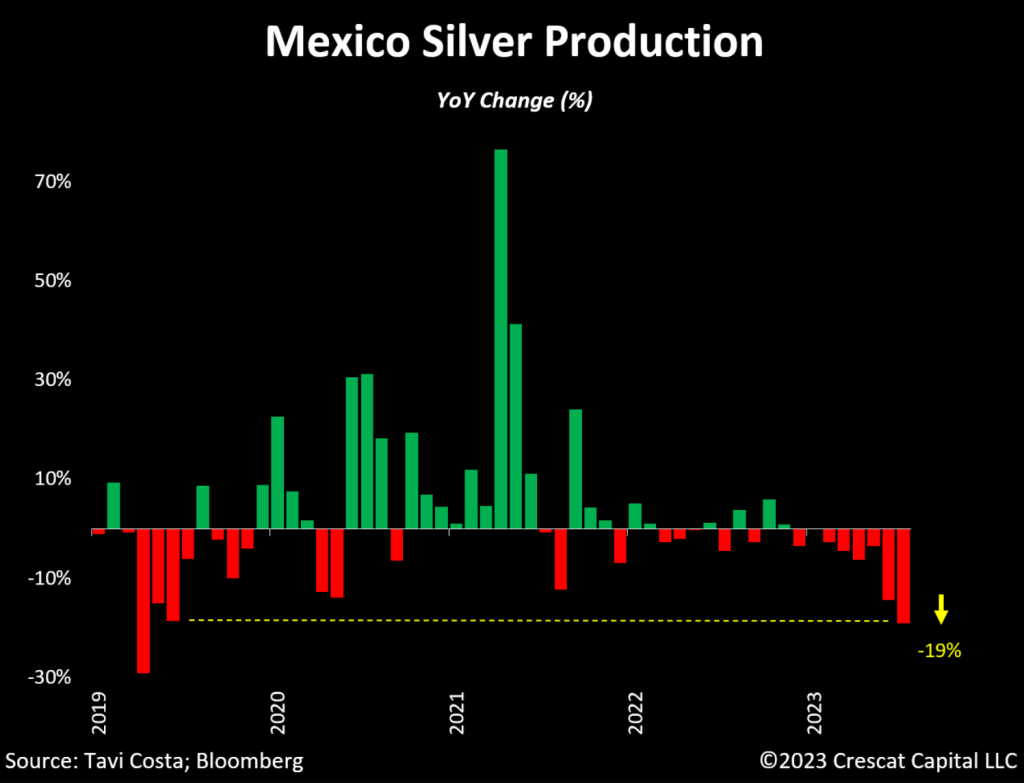

Mexico – The Catalyst.

Mexico just reported its steepest decline in annual production of silver in 4 years, which is notably worse than during the Covid lockdowns.

Not forget that Mexico is by far the largest producer of the metal in the world today.

The supply of silver remains remarkably constrained, and if this is indeed the beginning of another gold cycle, the metal could be worth multiples of its current price.

KEY LEVEL

If we consider this a failed structure, it is no less that PA is out of the Fork (MarkDown). What we have consider as a BackUp few charts above, could be called a Spring18, with a pull back on the MidRange (as luck would have it on 0.618 Fibo19 retracement!) – LPS. And once again, it JAC, plus 3 taps on 0.618.

3 blue candles triggered (04.04.23 ; 10.07.23 ; 21.08.23), with the reduce of the volume, could be a Sign of the insistence to break it definitely. Mid Range might be the 1st Target, 50$ the second. 26.9$ (VAH20 might be the Key)

If it happen, the journey still remains long. This is not crypto, this is a commodity. Even if PA has re-integrated the range, it currently trading below the POC21 (23.89$). 26.9$ (VAH) should be broken. This will confirm a definitive exit and here the “Creek” (BU) could be the LPS before take off to 30$.

If it fail with a clear re-integration, it should drop below 20$ to confirm any Bear scenario.

- silver ticker ↩︎

- Phase A of Wyckoff method ↩︎

- Wyckoff method ↩︎

- Wyckoff method ↩︎

- Jump Across the Creek – Wyckoff phase D (Accumulation) ↩︎

- BackUp (wyckoff) ↩︎

- Volume profile terminology ↩︎

- Sign of Stregth (Phase E of Wyckoff method) ↩︎

- Timeframe ↩︎

- MarketMakers ↩︎

- Price action ↩︎

- Risk reward Ratio ↩︎

- Stop loss (trading strategy) ↩︎

- World Silver Survey (source) ↩︎

- Exchange-Traded Products ↩︎

- Special Military Operation ↩︎

- London Bullion Market Association ↩︎

- Accumulation Phase C (Wyckoff method) ↩︎

- Fibonacci retracement ↩︎

- VAlue High (volume profile level) ↩︎

- Point of Control (volume profile level) ↩︎