$XAU, Weekly

1677 – 2074… those figures does not correspond to a chronological period, but indeed to a range that has prevailed for over 3 years !

1865$ is the mid range and PA1 is very close to this level. Once tested, this will confirm is MM2 will play lower part once again and make a new LL3, continuing to progress into the OBVIOUS MarkDown4!

Here is the point : Change of the Force (breaking by the LOW and acceleration to seek further down levels) or make a SPRING5 into this Failed structure before break it and STOP the trend….

ANYWAY , DOUBLE #BLACKSTRAT SIGNALS REJECTIONS on Weekly TF6 has perfectly showed us the actual rejection to go higher !

BELOW THE RIBON7 and above the mid Range…. It seems inevitable that MM want make GOLD kissing its 200 8!

RENDEZ-VOUS at the POC9 level !

Behind the charts.

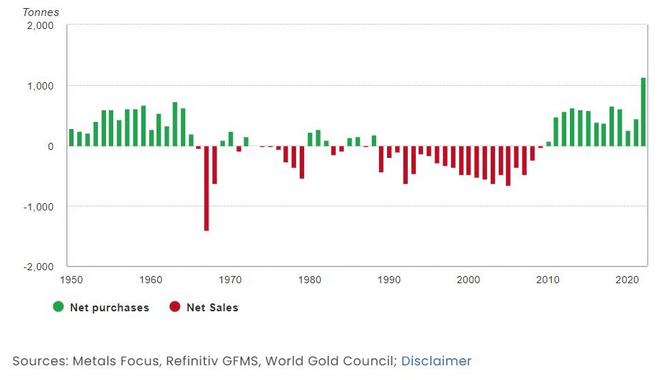

According to WGC10, central banks added a whopping 1,136 tonnes of gold worth some $70 billion to their stockpiles in 2022, by far the most of any year in records going back to 1950,

The data underline a shift in attitudes to gold since the 1990s and 2000s, when central banks, particularly those in Western Europe that own a lot of bullion, sold hundreds of tonnes a year.

Since the financial crisis of 2008-09, European banks stopped selling and a growing number of emerging economies such as Russia, Turkey, India and of course China have bought.

Central banks like gold because it is expected to hold its value through turbulent times and, unlike currencies and bonds, it does not rely on any issuer or government.

Gold also enables central banks to diversify away from assets like U.S. Treasuries and the dollar

BRICS Will Continue to Be Huge Buyers

If you look back at the list of net buyers, you will notice that three are members of the BRICS11 countries. For the first time ever, BRICS share of the global economy has surpassed that of the G712 nations on a purchasing parity basis.

Gold plays an important role in this multi-polarization. The BRICS need the precious metal to support their currencies and shift away from the U.S. dollar, which has served as the global foreign reserve currency for about a century. More and more global trade is now being conducted in the Chinese yuan, and there are reports that the BRICS—which could eventually include other important emerging economies such as Saudi Arabia, Iran and more—are developing their own currency.

If this is indeed the case, the implication is clear to me that investors should be increasing their exposure to gold and gold miners. Gold is a finite resource. It’s expensive and time-consuming to produce more of it. At the same time, BRICS countries will continue to be net buyers as they seek to diversify away from the dollar.

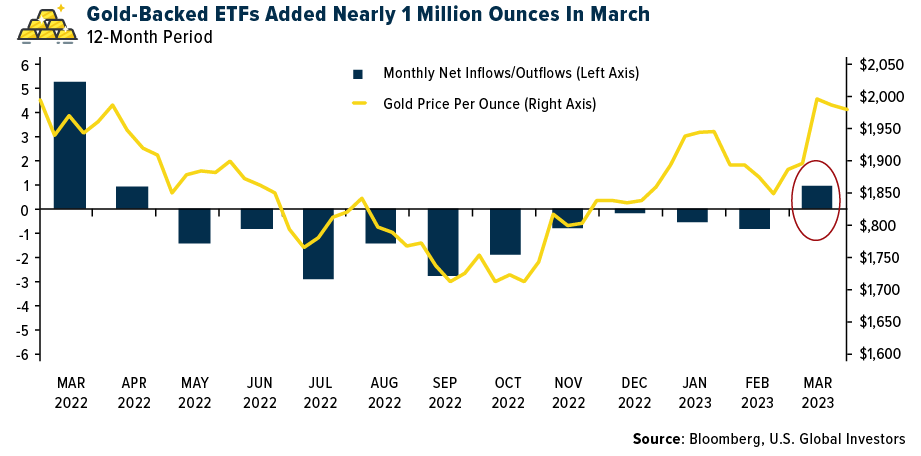

Net Inflows into Gold-Backed ETFs Turn Positive

Net inflows into gold-backed ETFs turned positive in March after 10 straight months of outflows as the metal’s price flirts with a new record high. Investors added nearly 1 million ounces to all known physical gold ETFs in March, the highest monthly increase since March 2022, when investors added 1.4 million ounces. As of March 31, total gold holdings stood at 93.2 million ounces, according to Bloomberg.

- Price Action ↩︎

- Market Makers ↩︎

- Low Low ↩︎

- Market Down channel ↩︎

- Brutal squeeze (Wyckoff methodology) ↩︎

- Time Frame ↩︎

- Exponential Moving Averages “tape” ↩︎

- EMA 200 periods ↩︎

- Point of Control (Volume profile methodology) ↩︎

- World Gold Council ↩︎

- Brazil, Russia, India, China and South Africa ↩︎

- Canada, France, Germany, Italy, Japan, the U.K. and U.S ↩︎