The Six-Day War, which took place in June 1967, had significant implications for the oil crisis that followed. The conflict involved Israel and the Arab states of Egypt, Jordan, and Syria. Israel emerged victorious and gained control of the Sinai Peninsula, the West Bank, East Jerusalem, and the Golan Heights. This military success had profound geopolitical and economic consequences, leading to the oil crisis of 1973.

The oil crisis of 1973, often referred to as the “1973 oil embargo” or the “Yom Kippur War oil crisis,” was triggered by a combination of factors, including political tensions in the Middle East and the Arab-Israeli conflict. In October 1973, during the Jewish holiday of Yom Kippur, Egypt and Syria launched a surprise attack against Israel, seeking to regain territories lost in the Six-Day War.

In response to the conflict, the Arab members of the Organization of Arab Petroleum Exporting Countries (OAPEC), led by Saudi Arabia, imposed an oil embargo against the United States, Canada, and several Western European countries that were perceived as supporting Israel. The embargo was later extended to the Netherlands, Portugal, and South Africa.

The impact of the oil embargo was severe. Oil prices skyrocketed, and there were widespread shortages in the affected countries. The crisis highlighted the dependence of the industrialized world on Middle Eastern oil and exposed vulnerabilities in the global energy supply.

The embargo also had lasting effects on energy policies and geopolitics. It led to increased efforts to diversify energy sources, promote energy conservation, and develop alternative energy technologies. Additionally, it prompted a reevaluation of international relations and alliances in the context of energy security.

In summary, the Six-Day War of 1967 laid the groundwork for the geopolitical tensions that contributed to the oil crisis of 1973. The embargo and its aftermath had far-reaching consequences, shaping energy policies and global relations for years to come

Here is a chart of Crude back in 1973, in October was the date OPEC increased OIL by 200% which we can see caused the spike in OIL for those WHO supported Israel causing higher prices on peoples way of living and of course people don’t sign up to this nonsense, it is the elites WHO always causes this bullshit!.

BUT

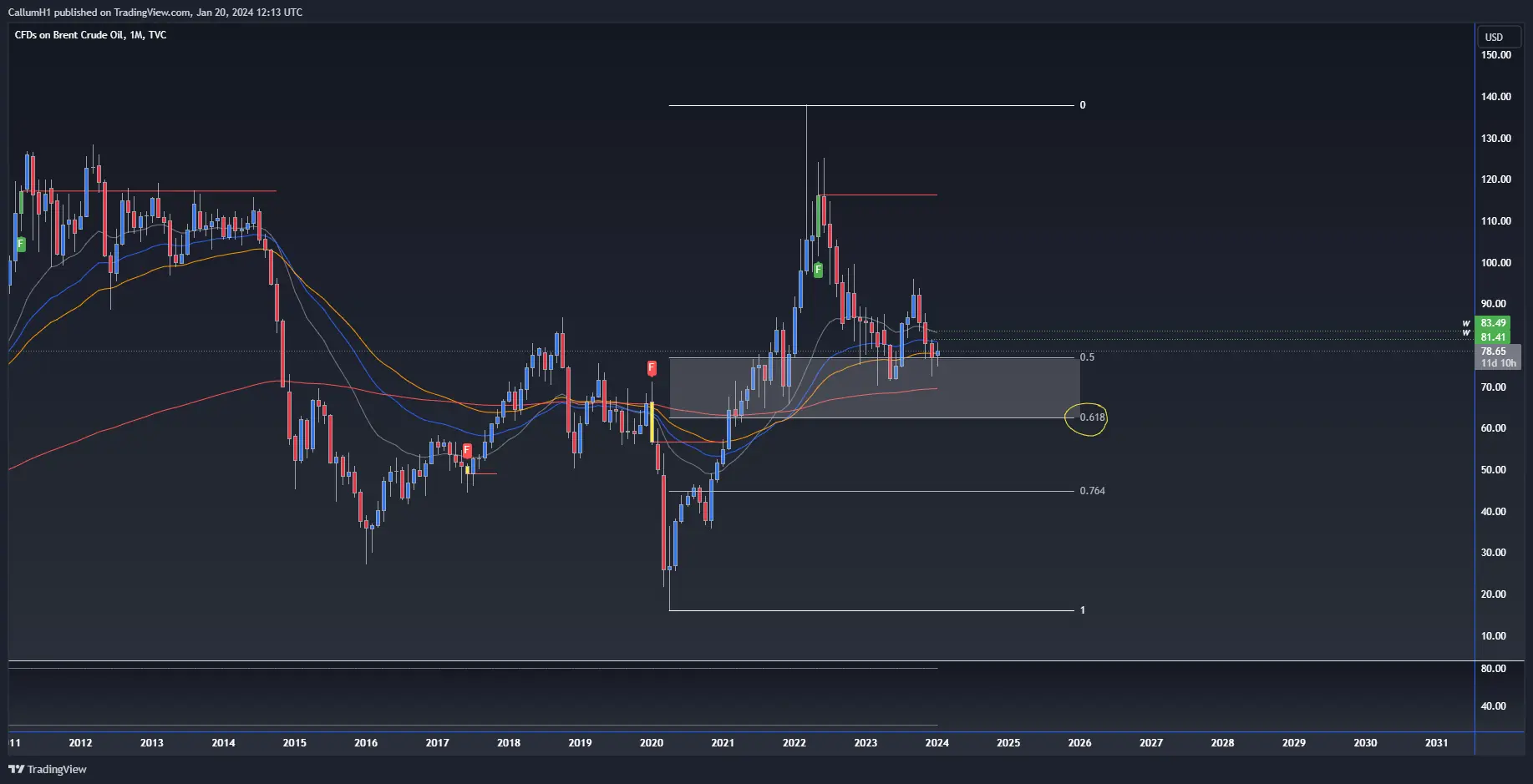

It is very important to see what the charts suggest as they are always the ones who gives us the clues to where it may find its bottom, so here I share a few different TIMEFRAMES so we can fully understand and see where we potentially may find a bottom… because all of the factors are here!

Before we get into more detail about the 1970s recession, here is some charts.

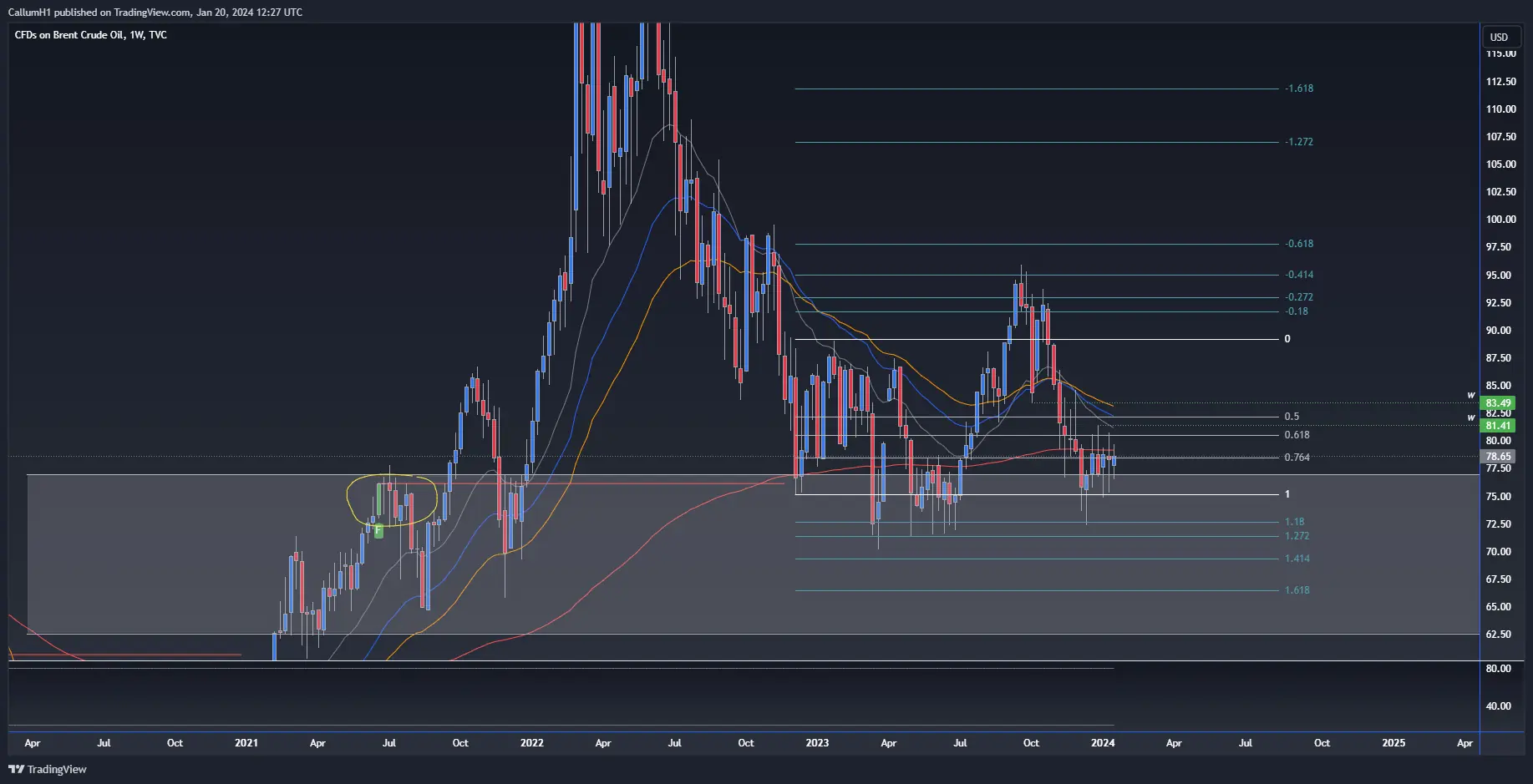

First we start with the monthly and weekly , as on the weekly we are sitting on a weekly #FORCE provided by #BLACKSTRAT $76.18 and on the monthly we are sitting on the 0.5% fib level which may hold?

As we can see on the monthly chart we have shaded in the 0.5% in between the 0.618% which is our SUPPORT , right now we are sitting just above the 0.5% , but is it time to buy?

With the weekly I have circled the #FORCE which has held many times providing many opportunities and it seems like it is holding , but only for a target of $80 which seems likely in FEB , but here we are talking about the next secular trade for $UKOIL too skyrocket into highs. WHICH WILL HAPPEN , BUT ITS ALL ABOUT WHEN NOT IF

Source :

https://www.federalreservehistory.org/essays/oil-shock-of-1978-79